How to Trade Profitably on Crypto Futures, It’s no secret that the cryptocurrency industry is one of the most volatile and unpredictable markets in the world. In the past decade, we’ve seen Bitcoin go from being worth less than a dollar to more than $20,000. And as the industry continues to grow and mature, we’re seeing more financial products and services emerge that allow investors to trade cryptocurrencies more easily and profitably.

One such product is crypto futures. In this blog post, we will explore what crypto futures are and how you can trade them profitably in 2023. We will also touch on some of the risks involved in trading crypto futures and how you can mitigate them.

What Are Crypto Futures?

Crypto futures are exchange-traded contracts that allow investors to speculate on the future price of a cryptocurrency. Futures contracts are derivative instruments that derive their value from an underlying asset, in this case, a cryptocurrency.

Crypto futures can be used to hedge against the risk of cryptocurrency price fluctuations or to speculate on the future price of a cryptocurrency. For example, if an investor believes that the price of Bitcoin will increase in the future, they can buy a BTC futures contract to lock in a price at which they can buy Bitcoin at a later date.

Conversely, if an investor believes that the price of Bitcoin will decrease in the future, they can sell a BTC futures contract to lock in a price at which they can sell Bitcoin at a later date.

Crypto futures contracts are traded on exchanges such as Binance Futures and OKEx. These exchanges offer different contract types with different margin requirements and leverage options.

Investors should carefully consider their investment objectives, risks, charges, and expenses before investing in crypto futures. The value of a futures contract may fluctuate based on changes in the underlying asset’s price, changes in interest rates, and other factors

The Different Types of Crypto Futures

Crypto futures contracts are agreements to buy or sell an asset at a set price at a future date. Futures contracts are standardized so that they can be traded on an exchange. The value of a futures contract is derived from the underlying asset, in this case, cryptocurrencies.

There are two types of crypto futures: spot and margin. Spot futures are cash-settled and margined futures are physically delivered. With spot crypto futures, traders can take advantage of price movements without having to own the underlying cryptocurrency. Margin crypto futures require traders to put down a deposit, or margin, in order to trade. Margin deposits protect the exchange in case the value of the contract drops below the margin.

Both types of futures have their own benefits and risks. Spot crypto futures allow for more flexibility as traders are not tied down to one particular coin, but they also come with the risk of being subject to wild price swings. Margin crypto futures offer more stability, as the margin protects against large losses, but they also require traders to put up extra money as collateral.

To trade profitably on crypto futures, it is important to understand the different types of contracts available and how they work. It is also important to be aware of the risks involved in each type of contract before entering into any trades.

Pros and Cons of Trading Crypto Futures

When it comes to trading crypto futures, there are pros and cons that must be considered. On the one hand, trading crypto futures allows traders to speculate on the future price of cryptocurrencies without actually owning them. This can be advantageous because it allows for greater flexibility and potential profits. On the other hand, trading crypto futures also comes with risks, as prices are highly volatile and can fluctuate rapidly.

Crypto futures contracts also have various expiration dates, which is another factor to consider. If a trader believes that the price of a certain cryptocurrency will rise in the future, they can buy a “call” option. Conversely, if a trader believes that the price of a certain cryptocurrency will fall in the future, they can buy a “put” option.

It is important to remember that with any type of trading, there are always risks involved. Before entering into any trade, it is essential to do your own research and understand all of the potential risks and rewards.

What to Consider When Trading Crypto Futures?

When trading crypto futures, there are a few key factors to consider in order to trade profitably. The first is the volatility of the underlying asset. Cryptocurrencies are notoriously volatile, and this can make for some wild swings in price action when trading crypto futures. It’s important to be aware of this volatility and factor it into your trading strategy.

Another key factor to consider when trading crypto futures is the liquidity of the market. Because crypto futures are still a relatively new product, the liquidity can be low at times. This can make it difficult to enter or exit trades quickly, so it’s important to take this into account when making your trading decisions.

Finally, it’s also important to be aware of the fees associated with trading crypto futures. These fees can eat into your profits, so it’s important to take them into account when planning your trades.

How to Trade Crypto Futures?

If you’re looking to trade crypto futures, there are a few things you need to know. Here’s a quick rundown of what you need to do to start trading crypto futures:

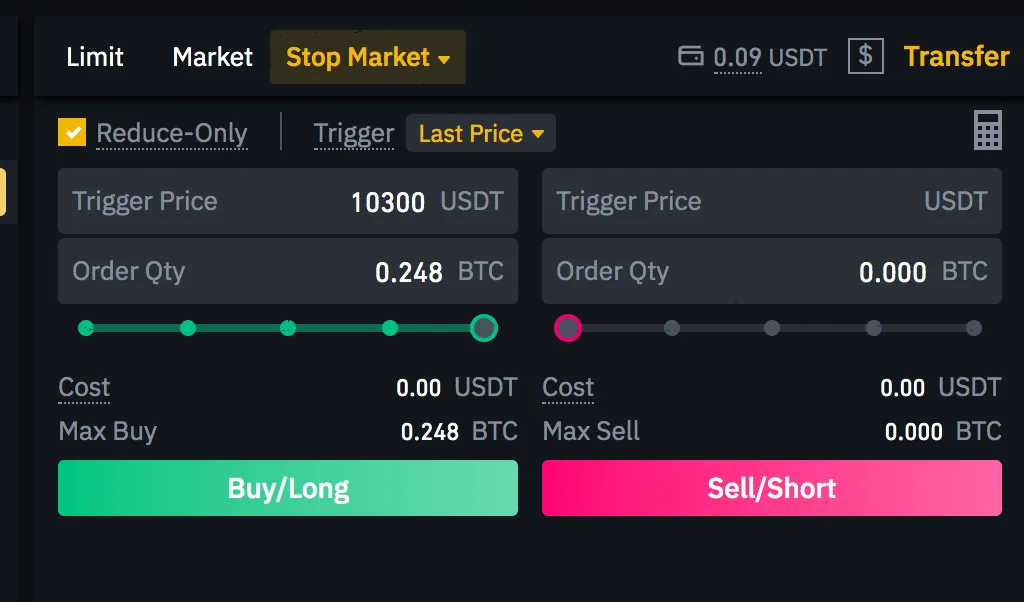

1. Find a reputable exchange that offers crypto futures trading. There are a few exchanges that offer this, so do your research and find one that suits your needs.

2. Learn the basics of trading futures. This includes understanding terms like “contract size,” “margin requirements,” and “settlement date.”

3. Decide what kind of strategy you want to use. There are many different ways to trade futures, so it’s important to find the method that best fits your goals and risk tolerance.

4. Place your trades and monitor them closely. Futures trading can be volatile, so it’s important to stay on top of your positions and make sure they’re performing as expected.

5. Close out your positions when you’re ready. When you’re done trading for the day, or when your target profit is reached, be sure to close out your positions so you don’t get caught in a losing position overnight.

Conclusion

As we can see, there are a few key things to keep in mind if you want to trade crypto futures profitably. First, make sure you have a clear understanding of the market and the underlying asset. Second, use a reliable platform that offers a good liquidity and tight spreads. Finally, don’t forget to set stop losses and take-profits, so you can limit your losses and lock in profits. By following these tips, you’ll be in a much better position to trade crypto futures successfully.

Learn more about: You Need to Know About a Blockchain Wallet