Stock market– meaning and definition

What Are Stocks and How Do They Work in detailed, A stock is a type of security that represents ownership in a corporation. Stockholders are entitled to partial ownership of the corporation, and they share in the profits and losses of the business.

The value of a stock is determined by the market, which is the collective assessment of all buyers and sellers of that particular security. The market price of a stock may fluctuate daily, or even hourly, as new information about the company becomes available.

Investors typically purchase stocks with the goal of earning a return through capital appreciation, which is an increase in the stock’s value over time. Dividends are another way that investors can earn a return on their investment, though not all companies offer dividends.

When dividends are paid out, shareholders receive a portion of the company’s profits based on their ownership stake Companies typically pay out dividends quarterly, though some may do so monthly or annually.

Dividends are a source of stable income for investors, but it’s important to remember that companies can reduce or eliminate dividend payments at any time.

What Are Stocks and How Do They Work? In detailed

When looking at dividend stocks, it’s important to consider a company’s history of paying dividends and whether the stock is trading at a reasonable price.

There are two types of common stock: Class A and Class B shares. Class A shares typically have one vote per share, while Class B shares may have 10 or more votes per share.

Many companies offer both types of stock to give shareholders different voting rights, but some only offer one type or the other.

For example, Facebook (NASDAQ: FB) only offers class A common stock to trade on the Nasdaq exchange; Berkshire Hathaway (NYSE: BRK-A)(NYSE: BRK-B) offers both class AandClass B shares; Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG) has three classes of common stock.

Preferred stock is a type of equity that has a preference over common shares when it comes to dividend payments and the liquidation of assets.

Preferred shares often don’t have voting rights, but they may offer a higher dividend than common shares. For example, Berkshire Hathaway’s Class A preferred stock (NYSE: BRK-A) pays an annualized dividend of $2,500 per share and has a par value of $100,000 per share.

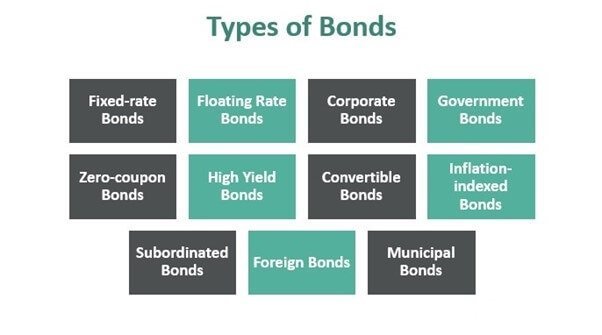

What are the different types of bonds?

Bonds are debt securities that companies issue to raise capital for their operations. Companies issue bonds with different maturities — meaning when the bond will be repaid in full — and interest rates depending on their needs at the time.

For example, if a company needs to raise money quickly because it’s facing financial difficulties or is expanding rapidly, it might issue short-term bonds with higher interest rates than long-term bonds; if the company is financially healthy and isn’t in need of immediate cash flow but wants to finance long-term growth projects such as building new factories or hiring more employees, it might issue long-term bonds with lower interest rates instead.

The terms “maturity” and “interest rate” are inversely related: The longer the maturity, the higher the interest rate, and vice versa.

The different types of bonds are:

Treasury bonds: Treasury bonds are issued by the U.S. government and are considered to be among the safest investments because they’re backed by the full faith and credit of the federal government; in other words, if you buy a U.S. Treasury bond, you’re lending money to the federal government, which is considered a very low-risk investment.

The downside of treasury bonds is that they offer relatively low returns compared with other types of investments; for example, 10-year Treasury bonds currently yield about 2%.

Treasury bonds are issued by the U.S. government and are considered to be among the safest investments because they’re backed by the full faith and credit of the federal government; in other words, if you buy a U.S. Treasury bond, you’re lending money to the federal government, which is considered a very low-risk investment.

The downside of treasury bonds is that they offer relatively low returns compared with other types of investments; for example, 10-year Treasury bonds currently yield about 2%.

Municipal bonds: Municipal bonds are issued by cities, states, and other local governments and agencies to finance public projects such as building schools or highways. They’re considered to be among the safest investments because they’re backed by the full faith and credit of the issuing entity; in other words, if you buy a municipal bond from your state or city, you’re lending money to your state or city government.

The downside of municipal bonds is that they offer relatively low returns compared with other types of investments; for example, 10-year municipal bonds currently yield about 2%.

Municipal bonds are issued by cities, states, and other local governments and agencies to finance public projects such as building schools or highways. They’re considered to be among the safest investments because they’re backed by the full faith and credit of the issuing entity; in other words, if you buy a municipal bond from your state or city government. The downside of municipal bonds is that they offer relatively low returns compared with other types of investments; for example, 10-year municipal bonds currently yield about 2%. Corporate bonds: Corporate bonds are issued by companies to finance their operations. They’re considered to be relatively safe investments because they’re backed by the full faith and credit of the issuing company; in other words, if you buy a corporate bond from a company, you’re lending money to that company.

The downside of corporate bonds is that they offer relatively low returns compared with other types of investments; for example, 10-year corporate bonds currently yield about 3%.

Corporate bonds are issued by companies to finance their operations. They’re considered to be relatively safe investments because they’re backed by the full faith and credit of the issuing company; in other words, if you buy a corporate bond from a company, you’re lending money to that company.

The downside of corporate bonds is that they offer relatively low returns compared with other types of investments; for example, 10-year corporate bonds currently yield about 3%. Junk bonds: Junk bonds are issued by companies with poor credit ratings.

They’re considered to be relatively risky investments because they’re not backed by the full faith and credit of the issuing company; in other words, if you buy a junk bond from a company, you’re lending money to that company without any guarantee that you’ll be repaid in full.

The upside of junk bonds is that they offer relatively high returns compared with other types of investments; for example, 10-year junk bonds currently yield about 5%.

What are exchange-traded funds?

An exchange-traded fund (ETF) is a type of investment vehicle that allows investors to invest in a basket of securities — such as stocks or bonds — in one transaction. ETFs trade on stock exchanges and can be bought and sold throughout the day like stocks.

ETFs typically have lower fees than mutual funds because they don’t have active managers making investment decisions; instead, they’re managed passively according to an index such as the S&P 500 or Dow Jones Industrial Average.

For example, if you want to invest in the S&P 500 but don’t want to buy 500 individual stocks, you can buy an ETF that tracks the index instead.

What are mutual funds?

A mutual fund is a type of investment vehicle that allows investors to pool their money together and invest in a basket of securities — such as stocks or bonds — in one transaction. Mutual funds are managed by professional money managers who make investment decisions on behalf of the fund’s investors.

Mutual funds typically have higher fees than ETFs because they have active managers making investment decisions; however, they may also offer higher returns because of this active management.

For example, if you want to invest in a basket of individual stocks but don’t have the time or expertise to pick them yourself, you can buy a mutual fund instead. What are real estate investment trusts?

A real estate investment trust (REIT) is a type of investment vehicle that allows investors to pool their money together and invest in a portfolio of real estate assets — such as office buildings, shopping malls, or apartments — in one transaction.

REITs trade on stock exchanges and can be bought and sold throughout the day like stocks. REITs typically offer high dividend yields because they’re required by law to pay out at least 90% of their taxable income to shareholders in the form of dividends.

For example, if you want to invest in a portfolio of commercial real estate properties but don’t have the time or expertise to manage them yourself, you can buy a REIT instead.