Can we convert cryptocurrency to cash? That is what a lot of people want to know. If that is your question, then this is going to be a very special article. To answer this question we are going to cover multiple angles with the goal of giving you a full understanding of how it can be done and helping you understand what it takes to do so.

There are a number of companies and financial investment groups that provide everything from card payments to wire transfers.

And just so you know, this is not your grandpa’s currency exchange service — today most companies and banks accept cryptocurrency payments. There are hundreds of online websites which provide identity verification as well as offer crypto conversion services.

How to Convert Cryptocurrency to cash 2023

Convert cryptocurrencies to cash. Pay cash for Bitcoin, Litecoin, Ethereum, and more with multiple payment options.

Cryptocurrency is a digital asset that can be exchanged and traded for cash, or you can use it to purchase goods and services. To convert cryptocurrency to cash, follow these steps:

If are you looking to convert cryptocurrency to cash, you can use some coin exchanges like CEX.IO and Coinbase.com to convert crypto to fiat money such as dollars and pounds.

Cryptocurrency has a number of advantages

The convenience and anonymity make it an attractive option for criminals using cryptocurrencies as currency to launder money. Your cryptocurrency can be converted to cash at the best rates the market offers.

Convert cryptocurrency to cash instantly, the most reliable and favorable exchange for cryptocurrency traders. The service is available 24/7 and offers same-day deposits and withdrawals.

The team at the exchange offers a convenient system for converting your cryptocurrencies into USD, EUR, or other fiat currencies.

With Cryptopay you can convert your digital currencies to cash. Just select the amount and place the order.

Quickly convert cash to Cryptocurrency. Online conversion service enables you to receive your funds within minutes and helps you understand how much it will cost you to buy in the future.

Payment gateway enables faster and more secure conversion from cryptocurrency to cash.

Why Transfer Bitcoin To Your Bank Account?

You can get higher returns in the stock market or a savings account by converting your bitcoin to USD. You’ll pay taxes on the profit, but it may be worth the risk considering many people are investing in bitcoin because they view it will grow in value over time.

If you have cryptocurrency, and you want to get it out of your possession, then it is important to consider the transaction fees and speed.

There are different ways that you can move your Bitcoin to your bank account: by converting them into dollars or euros using an exchange like Coinbase; transferring at a bank or via a SEPA transfer; or paying a bitcoin ATM fee.

Bitcoin is an international currency that has no central bank, no physical money, and no borders. You can use it to transfer money to friends or family abroad cheaply and quickly.

Store, swap, and spend bitcoins with BitPay: Buy crypto with no fees

It allows you to pay for goods by using a service called BitPay which connects your bank account to the blockchain. This helps track who owns what bitcoin and make sure nobody else uses your bitcoins when they aren’t allowed to.

The best way to move your bitcoin is to transfer them to an external wallet. This basically means that you’re moving your own private keys and the ownership of your bitcoins over to a new location in a separate wallet.

To do this, you will have to download the correct software and set up a secure password for the new wallet.

How to Move Bitcoin To A Bank Account?

It’s easy to convert your bitcoin to cash when you arrive in a new country. It’s just like ‘selling’ your bitcoin and ‘buying’ the equivalent value in dollars (or any currency of your choice).

It is determined by demand, not supply, that determines how much money you can get for your bitcoin – how many people want to buy bitcoin right now and what they are willing to pay.

There are two ways to move bitcoin to a bank account. The first is by selling your bitcoin and then simply making an online withdrawal from your exchange account.

The second way is by converting your bitcoins into USD/your fiat currency equivalent via different websites, but this process does involve some risk and can take days to complete (sometimes weeks).

The best way to move your bitcoin to a bank account is by selling them for fiat currency like the U.S. dollar, euro, or British pound. In a market of buyers and sellers, bitcoin and any other fiat currency will always exchange at the same rate.

Moving bitcoins to your bank account is a relatively easy process. Typically, you will be asked to provide your identity documents, including proof of address, utility bills, and a copy of your passport.

Amounts of BTC to be transferred, as well as information about the transaction, must be provided thereafter. As well as account details, you will need to specify the beneficiary’s name and the address where the money should be sent. You will also need some dollars to fund the transfer.

Cash-Out Methods

If you have bitcoin, you have the option to either sell them or convert them using a third-party exchange broker. Or, you can use a peer-to-peer transaction to directly sell them to another person (the rate is usually higher).

You can use an exchange broker to sell your bitcoin for cash. This is a safe and secure way to convert your bitcoin into cash. Or, you can use a third-party such as a bitcoin ATM or debit card instead to sell your bitcoin at set rates that may vary from exchange to exchange.

There are two main avenues to convert your bitcoins into cash: a third-party exchange broker, or a peer-to-peer transaction. The third-party trade options are usually offered by banks and banks will not cover most of the fees (the fees can be sold at a lower rate on the e-currency exchange platform).

Because of this, an individual should choose with caution when going through the process of selling their bitcoins on a third-party service.

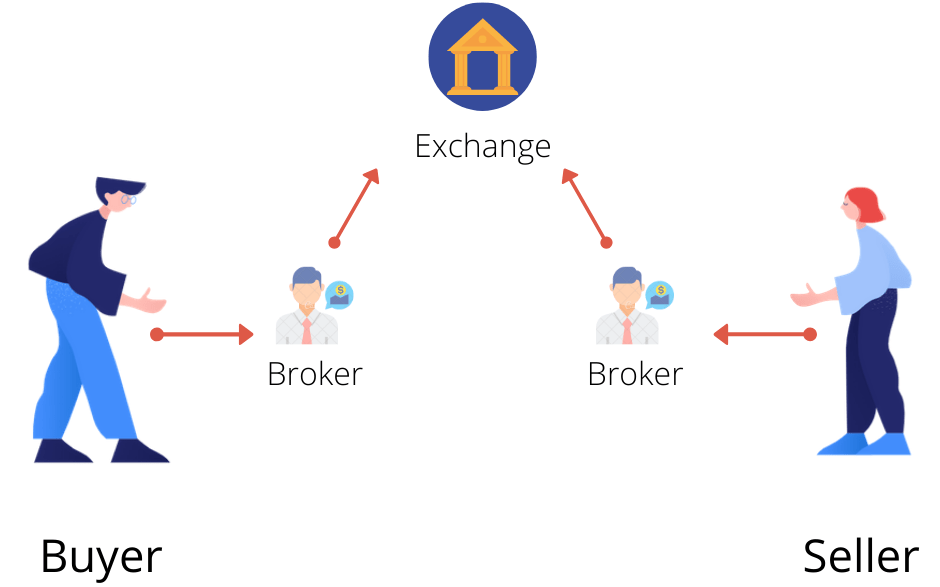

Third-Party Broker Exchanges

With a third-party broker, it’s as easy as picking up a phone and choosing the currency you would like to withdraw. The process is simple and secure, but there are some delays involved. It can take 4-6 days for your money to reach your bank account after the transaction has been completed.

If you want to trade BTC from a bank account, then a third-party broker is an option. Third-party broker exchanges offer the same exchange of cryptocurrencies for your cash as well as other digital currency like Bitcoin or Ethereum.

In terms of fees, third parties will usually charge you less than their financial partners. The biggest difference is in transaction speed – the faster a fiat exchange lets you withdraw your money, the higher its processing fees are.

Cryptocurrency exchanges are third parties that act as intermediaries between buyers and sellers. They are not operated by individual brokers, but rather by large companies.

The Bitcoin exchange has been the most popular cryptocurrency trading exchange over time due to the ease of use, security, and lower fees than those offered by other major exchanges

How Bitcoin Turn into Cash Using a Peer-to-Peer Exchange

If you’re a crypto trader, then there are two primary ways to turn your crypto coins into cash. The first option is to go with a brokerage firm that specializes in crypto trading, such as Robinhood and Webull.

After you complete the trade and receive your money, you can move on to another broker and repeat. The other alternative is to set up an account with an exchange like Coinbase or GDAX (formerly Gemini) and have your coins available to buy stocks, commodities, or other assets on their platform.

If you’re holding your crypto coins in a wallet that isn’t easily accessible, then it will be a challenge to deposit them into another exchange. This is because any bank or broker would need to access your private key and actually look up your cash balance.

Even if they were able to do this, they would still be able to just communicate with your device and get the information without having to actually play an active role themselves.

Cash-out at a Bitcoin ATM

With Bitcoin ATMs, you can access real cash in a matter of seconds and sell your digital currency. The process of cashing out is simple, just follow these steps: go to buy bitcoins at any Bitcoin ATM, scan your QR code, and automatically receive cash for your Bitcoins.

Bitcoin ATMs are a unique way to cash out your Bitcoins. When using a bitcoin ATM, you don’t have to worry about transferring your bitcoin directly to an exchange account or relying on any middleman.

Simply use the Bitcoin ATM machine and make sure you verify your identity with a digital signature before receiving your cash.

Buy bitcoin with a credit card, cash, or bank transfer. More than 300 different Bitcoin ATM machines worldwide to buy and sell bitcoins in more than 30 countries

Cashing Out Crypto lengthy process

Selling, exchanging, or converting cryptos can be a bit confusing. Some exchanges don’t allow you to get out of all cryptos and need an indirect route via Tether dollars. Once in dollars, you can cash them out

Converting crypto to dollars can be a lengthy process and requires the use of third-party software. When you convert your crypto to dollars, you need to make sure that the exchange will transfer or convert your funds back to cash automatically.

Although this may be possible, your funds may not be available in your bank account for several days after the exchange transfers the funds.

In general, the process goes something like this: You post trade in one crypto for another, withdraw your earnings, or transfer funds to your portfolio. Then you convert everything to dollars through an exchange.

You can trade crypto for crypto and then cash out to dollars. However, if you have a large amount of cryptocurrency, this method of exchange might be too slow for you, or it could require special approval from your exchange before you can start the process.

Considerations When Cashing Out Bitcoin

Bitcoin is a decentralized digital currency. It’s not backed by any government or central bank, and its value is determined by supply and demand.

Bitcoin is known for its volatility, which means that its value can change rapidly. This makes it a very good investment option for those looking to make money from their investments. However, there are certain things you need to consider before cashing out your bitcoin.

- Speed –Money may take a few days to reach your bank account if you are using a third-party broker exchange.

- Taxes –You must pay taxes on your profit income if you made a profit selling your bitcoin. When planning your tax year, keep this in mind. For tax purposes, any reputable broker exchange will report its transactions.

- Fees –Exchanging bitcoins for bank accounts are usually subject to fees.

Learn More About: Bitcoin Vault Price Prediction